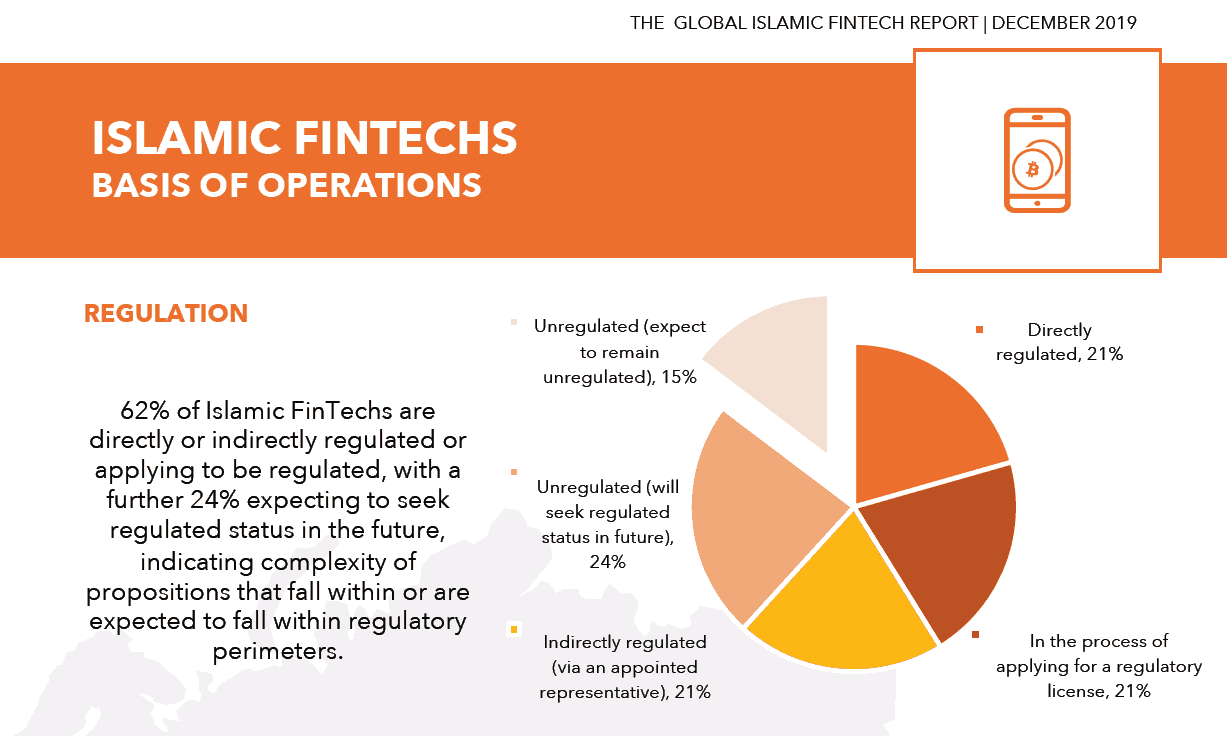

24% of Islamic fintech expect to seek regulated status in the future - a survey.

24% of Islamic fintech are unregulated but will seek regulated status in the future, according to the findings of a new survey released on Tuesday (Dec 10).

The survey also found that 21% of respondents are directly regulated, another 21% are indirectly regulated, meaning they work through an appointed representative, while 21% are in the process of applying for a regulatory license.

All of this indicates the "complexity of propositions that fall within or are expected to fall within regulatory perimeters," wrote the authors of the survey findings.

The survey forms the basis of the Global Islamic Fintech Report 2019 that is produced by London-based digital finance firm Elipses in collaboration with the UK Islamic Fintech Panel.

The survey was conducted with 180 companies worldwide across five categories: fintechs (50%), ecosystem players such as incubators and accelerators (22%), service providers such as law firms (16%), financial institutions (8%), and investors (4%), Elipses Co-founder and Principal, Abdul Haseeb Basit told Salaam Gateway.

The biggest group of respondents, at 38%, is based in the UK, followed by 28% in the Middle East, 14% in Other Europe, 12% based in Southeast Asia, 6% were from North America, and 2% from Other Asia.