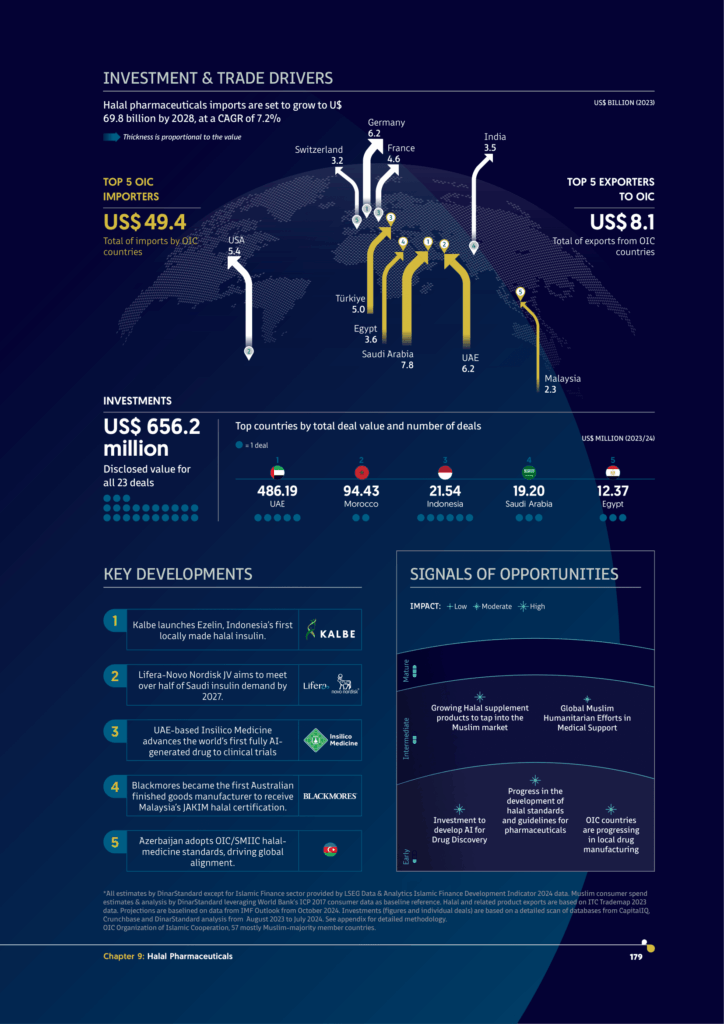

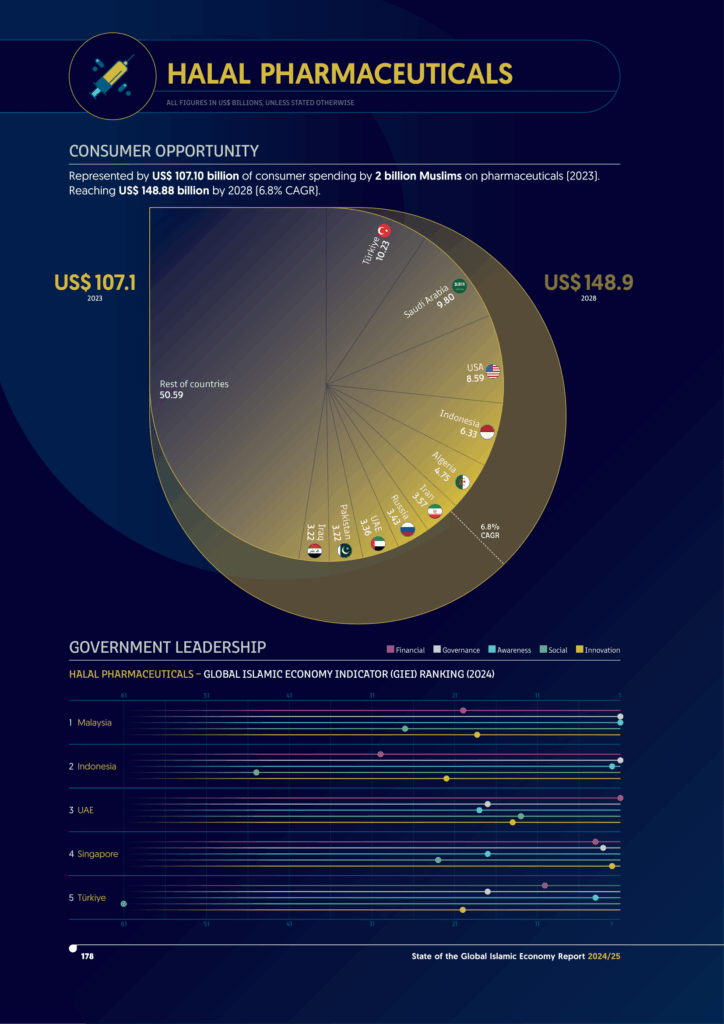

To Global Bankers, Institutional Investors, and Fintech Entrepreneurs,

Islamic Finance stands as the integral and largest component of the Global Islamic Economy (GIE), providing the Shariah-compliant capital necessary to fuel growth across all Halal lifestyle sectors—from food localization to digital media. With global Islamic finance assets reaching an impressive US$4.93 trillion in 2023 and projected to surge to US$7.53 trillion by 2028, the sector’s momentum is undeniable.

This robust growth is driven not just by demographic expansion, but by strategic shifts toward sustainability (ESG), digitalization (Fintech and CBDCs), and the continuous enhancement of regulatory frameworks in key markets. For sophisticated investors and financial institutions, understanding these drivers is essential to capitalizing on the sector’s projected 8.9% Compound Annual Growth Rate (CAGR).

This analysis, drawing from the State of the Global Islamic Economy Report 2024/25, provides a detailed strategic overview of the opportunities and challenges defining the future of Islamic Finance.

Part I: Market Overview and Investment Dynamics

While the sector continues its long-term asset growth, recent investment activity reflects prevailing global monetary policy adjustments, demanding cautious but targeted strategy.

1. The Scale of Islamic Financial Assets

- Dominant Force: Islamic finance assets constituted an estimated US$4.93 trillion in 2023.

- Sector Breakdown: Islamic banking remains the cornerstone, accounting for 72% of total Islamic finance assets.

- Market Leadership: Iran, Saudi Arabia, and Malaysia remain the largest Islamic financial markets globally. Malaysia holds the top position in the Islamic Finance ranking within the Global Islamic Economy Indicator (GIEI).

- Strong Growth Forecast: Global Islamic assets are projected to grow to US$7.53 trillion by 2028, maintaining a substantial 8.9% CAGR.

2. Investment Trends in a Tighter Market

Investment activity in Islamic Finance, measured by disclosed deal value (M&A, PE, VC), totaled US$1.98 billion across 59 transactions in the 2023/24 period.

- Deal Decline: The number of transactions declined significantly from 91 to 59 (a 35.16% drop) compared to the previous year. This decrease aligns with global economic adjustments, including rising interest rates and inflation in 2023/24, which generally reduced demand for capital-intensive projects.

- High Value Leaders: Despite the decline in volume, the average ticket size remained high (US$33.68 million).

- Saudi Arabia led in total deal value (US$727 million from 10 deals), underscoring its dominance and the high valuation of its market players (e.g., Tamara’s unicorn status).

- Indonesia followed with US$588 million (13 deals), driven by M&A activity like MUFG Bank’s acquisition of Mandala Multifinance.

- The UAE led in deal count (15 deals, US$157 million).

Strategic Insight: The focus on high-value deals in leading economies suggests that institutional investors are prioritizing stability and scale, making alignment with regional powerhouses (KSA, UAE, Indonesia, Malaysia) a core strategy.

Part II: The Fusion of Faith and Sustainability (ESG)

The inherent ethical mandates of Islamic finance are driving a powerful convergence with global Environmental, Social, and Governance (ESG) principles, establishing a clear pathway for sustainable investment.

1. The Green and Sustainable Sukuk Surge

- Rising Demand: The top trend in Islamic finance is the accelerating growth of Green and Sustainable Sukuk. Investor demand for environmentally and socially responsible assets is rising, pushing more issuers to label Sukuk as green or sustainable.

- Pioneering Issuances:

- Kuwait’s Warba Bank launched a US$500 million green sukuk, the first of its kind in Kuwait, which was oversubscribed 3.6 times.

- Indonesia issued a US$600 million green sukuk as part of its international offering.

- Saudi Arabia’s PIF started issuing both benchmark-sized three-year Sukuk and a Green Bond maturing in 2032.

- Global Standardization: The convergence is supported by global initiatives, such as the collaboration between the International Capital Market Association (ICMA), the Islamic Development Bank (IsDB), and LSEG, who published the first global guide for green and sustainable Sukuk.

2. Social Impact and Waqf Integration

Islamic social finance mechanisms are being actively leveraged to address global challenges, demonstrating the Social Impact dimension of the GIEI.

- Large-Scale Development: The IsDB approved its largest Islamic finance deal ever: a US$1.15 billion investment in Kazakhstan’s Climate-Resilient Water Resources Development Project, setting a precedent for large-scale, climate-focused Islamic finance applications.

- Microfinance and Poverty Alleviation: The Akhuwat Foundation in Pakistan surpassed a milestone of supporting six million families through its interest-free microfinance program, maintaining a remarkable 99.9% repayment rate.

- Waqf Innovation: The listing of the world’s first waqf-featured Exchange-Traded Fund (ETF) allows dividends from Shariah-compliant stocks to fund waqf projects supporting education, healthcare, and economic empowerment. Furthermore, the UNDP and Badan Wakaf Indonesia (BWI) introduced the Green Waqf Framework, integrating waqf assets with environmental sustainability goals.

Strategic Imperative: Investors are urged to focus on creating investment vehicles that blend rigorous Islamic standards with measurable social and environmental impact, capturing the values-aligned investor base.

Part III: The Digital Frontier: Fintech, Blockchain, and CBDCs

Technological innovation, particularly in Fintech and distributed ledger technology (DLT), is rapidly modernizing Islamic finance, enhancing efficiency and expanding market access.

1. Innovation in Digital Banking and Lending

- Digital Banks Emerge: Malaysia’s commitment to digital innovation is clear with the launch of AEON Bank, the country’s first fully digital Islamic lender. Similarly, Saudi Arabia launched the beta version of STC Bank, an Islamic digital bank transformed from the digital wallet company stc pay.

- Fintech Unicorns: Saudi Arabia’s fintech platform Tamara achieved unicorn status (US$1 billion valuation) after securing a US$340 million Series C equity funding round, highlighting the success of Shariah-compliant Buy Now, Pay Later (BNPL) and digital solutions.

- Crowdfunding and Takaful: Saudi Arabia is also advancing in crowdfunding, with Hala Financing securing a license for debt-based crowdfunding solutions. Furthermore, Indonesia’s Financial Services Authority (OJK) introduced new equity requirements for takaful (Islamic insurance) companies to strengthen financial stability.

2. Blockchain, Digital Sukuk, and CBDCs

The integration of blockchain is transforming the issuance and management of capital market products.

- Digital Sukuk Milestones: Russia made a significant entry by issuing its first-ever digital sukuk, leveraging blockchain technology to enhance transparency and efficiency. Malaysia’s Kapital DX debuted its inaugural RM150 million tokenized Shariah-compliant offering.

- CBDC Development: Both Iran (digital rial pilot) and Pakistan (exploring a non-interest-bearing, asset-backed CBDC) are signaling a growing preference for digital currencies compliant with Islamic finance principles, which prohibit interest and excessive speculation (gharar).

- Gold-Backed Stablecoins: Deenar, a gold-backed stablecoin, launched in Indonesia on the HAQQ Network, fusing Islamic finance principles with blockchain for a stable, Shariah-compliant digital asset.

- The Smart Stabilization System (SSS): The Islamic Development Bank Institute (IsDBI) introduced the Smart Stabilization System (SSS)—a self-funded, blockchain-enabled mechanism designed to stabilize financial markets without relying on conventional, interest-based tools. The SSS is applicable across Sukuk, Islamic equities, and CBDCs, offering a future-proof model for OIC central banks.

Strategic Imperative: Fintech startups and financial institutions must leverage AI and blockchain to create frictionless, Shariah-compliant services. Firms that embed robust governance and transparent pricing will capture market share as the ecosystem rapidly digitizes.

Part IV: Institutional Support and Regulatory Governance

Strong governance and institutional collaboration are key to overcoming fragmentation and accelerating cross-border capital flows, aligning with the GIEI’s Governance dimension.

1. Leadership in Regulatory Overhaul

- Malaysia’s Governance: Malaysia’s JAKIM continues to drive global Halal development through collaboration and mutual recognition of five additional foreign Halal bodies from South America and Asia. Bank Negara also published an exposure draft of Islamic banking window guidelines.

- Pakistan’s Reforms: Pakistan is spearheading comprehensive regulatory reforms, introducing Tier I and Tier II capital frameworks for Islamic non-bank financial institutions and finalizing an alternative Sukuk issuance structure to boost liquidity.

- Saudi Arabia’s Vision: The Capital Market Authority (CMA) proposed regulatory enhancements on debt instrument offerings, including Sukuk, streamlining processes for issuers.

2. The Standardization Challenge (Governance)

While progress is made, the sector still faces regulatory challenges, such as the potential impact of AAOIFI’s proposed Standard 62, which requires Sukuk issuers to transfer legal ownership of underlying assets to investors. While aimed at Shariah purity, this could complicate sovereign and corporate issuances due to legal restrictions on foreign asset ownership.

Strategic Imperative for Governments: Governments should focus on enhancing financial inclusion through Islamic microfinance (as seen in Pakistan and Burkina Faso) and leveraging Sukuk for major infrastructure projects (as demonstrated by Saudi Arabia and Türkiye). Regulators must prioritize the integration of AI infrastructure and regulatory sandboxes to foster innovation responsibly.

Part V: Strategic Opportunities by Stakeholder

A. Opportunities for Investors

- Green and Sustainable Sukuk: Invest in ESG-aligned Sukuk to meet the growing institutional demand for environmentally and socially responsible assets. Focus on issuances that fund renewable energy, sustainable infrastructure, and impact projects in OIC countries (e.g., Kazakhstan’s climate-resilient water project).

- Digital Sukuk and Blockchain: Fund startups and platforms that leverage DLT for issuing and trading digital Sukuk. This enhances efficiency, transparency, and reduces administrative costs, opening new investor pools globally (e.g., Russia’s digital Sukuk).

- Fintech and Digital Banking: Target high-growth digital platforms and digital banks that are leveraging AI/BNPL (Buy Now, Pay Later) to disrupt conventional lending and payments, capitalizing on the success of players like Tamara and the launch of AEON Bank.

B. Opportunities for Businesses (Certification, Fintech, Takaful)

- Develop Fintech Platforms: Create digital-first, Shariah-compliant financial solutions (e.g., gold-backed stablecoins like Deenar, or crowdfunding platforms like Mekyal) to bridge the accessibility gap for the young, tech-savvy Muslim population.

- Expand Shariah-Compliant Takaful: Focus on developing innovative Takaful (Islamic insurance) products, particularly in emerging markets, leveraging digital channels and focusing on ESG integration (e.g., Hijrah27 framework in Malaysia).

- Integrate AI for Governance: Implement AI and machine learning tools to enhance compliance, monitor Shariah requirements, and automate audit trails, especially in complex areas like cross-border supply chain finance, where transparency is paramount.

Source Reference: Chart/Table “ISLAMIC FINANCE SIZE OPPORTUNITY (US$ 4,925 billion in 2023, US$ 7,527.5 billion in 2028, 8.9% CAGR)” (Page 178).