The $6.25 Trillion Imperative: Navigating the Dynamics and Strategic Opportunities of the Global Islamic Economy

To the Global Business Leader and Investor,

The global economy is currently navigating a period defined by geopolitical instability, climate change concerns, and rapid technological disruption. Amidst these turbulent waters, a distinct and resilient market—the Global Islamic Economy (GIE)—continues its robust expansion, presenting a multi-trillion-dollar opportunity rooted in ethical consumption and value-based finance.

Often referred to as the Halal lifestyle market, the GIE transcends mere dietary restrictions; it represents an integrated ecosystem driven by the spiritual and ethical needs of the world’s Muslim population. For business leaders, particularly those operating in certification, manufacturing, and investment, understanding the structural drivers, key trends, and governance requirements of this market is no longer optional—it is an imperative for sustainable global growth.

This report, drawing heavily on the findings of the authoritative State of the Global Islamic Economy (SGIE) Report 2023/24, serves as your guide to mastering the fundamentals of this US$6.25 trillion opportunity.

Part I: Quantifying the Islamic Economy: Scale and Trajectory

The Islamic economy is defined by two primary pillars: consumer spending across six core sectors (Halal Food, Pharmaceuticals, Cosmetics, Modest Fashion, Muslim-Friendly Travel, and Media & Recreation) and the vast network of Islamic financial assets.

The Sheer Scale of Consumer Spending

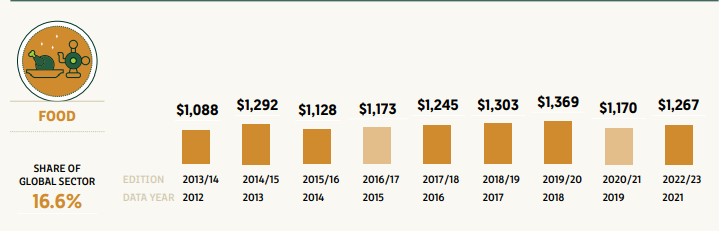

Over the past decade, the Islamic economy has transformed from a niche concept to a global force. In 2012, Muslim consumer spending was estimated at US$1.62 trillion. By 2022, this figure had surged to US$2.29 trillion.

This expenditure reflects a substantial 9.5% year-on-year growth from 2021. Projections indicate that this sustained momentum will continue, with Muslim spending across these sectors forecasted to reach US$3.1 trillion by 2027, sustaining a healthy 4.8% Compound Annual Growth Rate (CAGR).

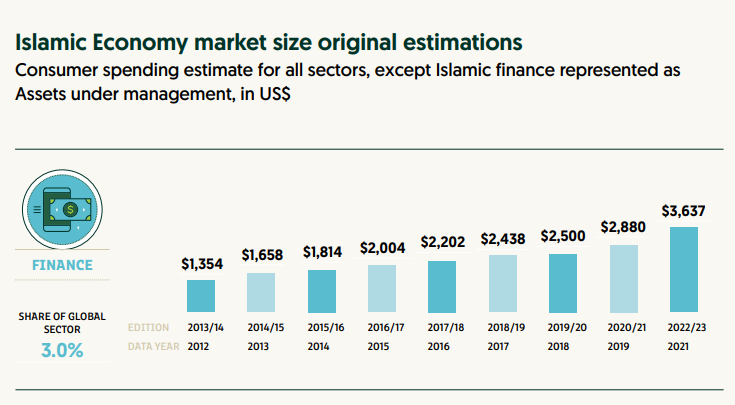

The Financial Engine: Islamic Finance Assets

Supporting this consumer market is the dynamic Islamic finance sector. Islamic finance assets were valued at US$3.96 trillion in 2021/2022. This valuation represents a remarkable 17% increase over the previous period (2020/2021). The industry is accelerating toward greater digitalization, sustainability, and financial inclusion. Islamic finance assets are expected to hit US$5.94 trillion by 2025/2026, growing at a strong 9% CAGR.

Investment Activity: A Surge in Confidence

Investor confidence in the GIE is reflected in dramatic growth in private sector engagement. Investments related to the Islamic economy—including mergers and acquisitions (M&A), private equity (PE), and venture capital (VC)—showed a staggering 128% growth in value, rising from US$11.4 billion (2021/22) to US$25.9 billion (2022/23).

Crucially, Islamic finance and media and recreation accounted for 75% of this total deal value. Leading the way in terms of the sheer number of deals were Indonesia (1st) and the UAE (2nd), with Türkiye and Malaysia sharing the 3rd position.

[Insert Chart Placeholder: “Global Islamic Economy Overview: Consumer Spend & Islamic Finance Assets (2022/2027 Forecast)” based on source]

Part II: Core Drivers of Expansion: Demand and Demographics

The sustained growth of the GIE is anchored in powerful demographic and economic trends that decision-makers must recognize.

1. The Young and Affluent Muslim Consumer

The Muslim population is a key global engine for growth. The total Muslim population currently exceeds two billion, representing more than 25% of the global population. This demographic is growing at about twice the rate of the non-Muslim population and is forecasted to reach 2.8 billion by 2050.

A major force driving consumption is the youth. In 2023, Muslim youth and young adults (ages 15-29) constituted 27.8% of the world’s total youth demographic. This concentration of Gen Z and Millennials, who are among the largest spenders globally, ensures continued demand for value-aligned products and services.

Furthermore, increasing affluence plays a critical role. The overall GDP of OIC member countries is forecasted to increase by 21.7% to reach US$25.4 trillion in 2023. Several Muslim-majority nations, including all GCC countries, have GDP per capita figures above the global average, providing strong purchasing power for quality and ethical products.

2. The Centrality of Islamic Values and Ethical Alignment

The term Halal (permissible) is a core concept that structurally affects all six sectors of the economy. However, Halal products must also be Tayyib, an Arabic term meaning “good or wholesome,” which extends the requirements beyond mere permissibility to encompass essential ethical values. This emphasis on Tayyib accounts for critical considerations such as food safety, animal rights, social justice, and welfare in production.

This comprehensive ethical framework gives the Halal industry a universal appeal, resonating deeply with non-Muslim ethical consumers who prioritize sustainability and corporate social responsibility. Brands like Saffron Road and Iba Cosmetics, for instance, have successfully leveraged this intersection to attract broader ethical consumer segments.

3. Understanding the Halal Consumer Spectrum

For businesses, recognizing the non-homogenous nature of the Muslim market is vital for effective strategy. The SGIE report breaks down Muslim consumers into four distinct segments based on their awareness and adoption of Islamic principles in consumption:

- Selective Observers: Aware of tenets but selective (e.g., avoid pork/alcohol but may not adhere to strict Halal meat standards).

- Conscious Consumers: Actively seek Halal in food but may overlook its importance in other areas like cosmetics or pharmaceuticals.

- Complete Observers: Expand compliance beyond food to include cosmetics, pharmaceuticals, and Islamic finance, and adhere to modest dress.

- Dedicated Observers: Maintain a rigorous approach, often insisting on formal Halal certification for relevant products.

This segmentation highlights the necessity of credible certification. For a Complete Observer like Laura Hassan (USA), the core concern is the origin of ingredients, such as gelatin in capsules or the presence of antibiotics/steroids in meat. Similarly, Ismail Bennani (France) noted the need for an app to scan products for non-Halal ingredients due to uncertainty in big markets. This pervasive demand for guaranteed compliance validates the critical role of certification bodies.

4. The Digital Transformation Accelerator

Digital connectivity is a major enabler across the GIE. The Middle East and Africa are projected to experience significant growth in internet usage, reaching an estimated 653.7 million users by 2027.

This digital adoption fuels e-commerce growth, especially in high-income regions like the GCC, where e-commerce revenue is projected to reach US$50 billion annually by 2027. This transformation facilitates innovative platforms in Islamic Fintech (e.g., Wahed), social retail (e.g., Evermos), and media (e.g., Durioo+). However, the current limitations of digital tools, such as the Halal scanner apps being described as “very limited” by consumers, underscore the urgent need for verifiable, comprehensive digital Halal compliance solutions.

Part III: The Enabling Ecosystem: Governance and Investment

The supply-side growth of the GIE is supported by dedicated governmental strategies, major international investments, and necessary regulatory oversight.

1. Government Leadership and National Strategies

Governments within the Organization of Islamic Cooperation (OIC) are instrumental in regulating the industry. Countries like Malaysia, Indonesia, Saudi Arabia, and the UAE have proactively incorporated the Islamic economy into their national economic diversification strategies.

National government bodies act as enablers, monitoring and providing accreditation for Halal certification requirements, crucial for both local development and imports. Examples include Malaysia’s JAKIM, the UAE’s ESMA/EIAC, and Saudi Arabia’s SFDS. These efforts have been instrumental in heightening awareness of compliance requirements among manufacturing companies worldwide.

The Global Islamic Economy Indicator (GIEI) consistently ranks Malaysia (1st), Saudi Arabia (2nd), and Indonesia (3rd) as the top national ecosystems best positioned to support Halal business activity.

2. Trade Flows and the Localization Trend

OIC member countries imported US$359 billion worth of Halal-related products in 2022, with projections showing growth to US$492.4 billion by 2027.

A notable structural imbalance exists: most OIC countries are import-dependent. Alarmingly for OIC members, the top exporters of Halal-related products to OIC nations are frequently non-OIC members, including China, India, Brazil, and the USA. Brazil, for example, is known as a major exporter of Halal poultry. This dependency creates a critical opportunity and challenge, necessitating strong Halal certification frameworks to ensure foreign products meet local religious and regulatory requirements.

The urgency of this situation, exacerbated by supply chain disruptions and global conflicts, has driven strong localization and regionalization initiatives. Saudi Arabia’s Public Investment Fund (PIF) has been particularly active, launching the Halal Products Development Company (HPDC) to localize the Kingdom’s Halal production industry. Similarly, initiatives like SaudiVax and Indovax aim to strengthen domestic vaccine and biopharmaceutical production within OIC countries, highlighting the criticality of localizing Halal Pharma.

3. The Quest for Unified Standards

Despite strong localized governance, the goal of achieving a single, globally harmonized Halal standard remains a challenge. Organizations like the Standards and Metrology Institute for Islamic Countries (SMIIC) struggle to unify fragmented markets. This fragmentation renders global trade less efficient.

However, progress is being made through bilateral and multilateral mutual recognition agreements, such as those signed between the Saudi Food and Drug Authority (SFDA) and Malaysia’s JAKIM, and Indonesia and Iran establishing cooperation in Halal product assurance. These agreements are essential for streamlining certification and facilitating cross-border Halal commerce.

Part IV: Sector Opportunities: A Strategic Snapshot

For investors, understanding the high-growth sectors within the GIE is critical. Here is a snapshot of the consumer spend and growth potential across the six core sectors (2022 data):

| Sector | 2022 Muslim Spend (US$ Billions) | CAGR (2022-2027) | Key Growth Drivers (Source Evidence) |

|---|---|---|---|

| Halal Food | $1,403 | 6.1% | Food security concerns, agri-tech investment (Advanta Seeds $300M), and localization (HPDC). |

| Islamic Finance | $3,958 (Assets) | 9.0% | Digitalization, Fintech (Akulaku, Islamic Coin $200M), Sustainable/Green Sukuk. |

| Media & Recreation | $247 | 6.8% | Major investments (Savvy Gaming $4.9B acquisition of Scopely), ethical content creation (Ms. Marvel, Durioo+). |

| Halal Cosmetics | $84 | 8.9% | Post-pandemic rebound (lipstick sales), AI/AR innovation, and Korean beauty influence in MENA. |

| Modest Fashion | $318 | 6.1% | E-commerce, Omnichannel retail, growth in modest sportswear. |

| Halal Pharma | $108 | 5.7% | Localization (Lifera, M42), and digital traceability (Tatmeen in UAE). |

Halal Cosmetics currently holds the highest projected CAGR (8.9%) among the lifestyle sectors, driven by factors like the relaxation of mask-wearing regulations which boosted makeup demand. Meanwhile, Halal Pharma is transforming through necessity, shifting toward regionalization to address import dependency and inflation. Key initiatives like the launch of M42 in Abu Dhabi and PIF’s Lifera demonstrate a significant capital injection into local biopharma and drug manufacturing capacity.

[Insert Image Placeholder: “Table/Chart of Muslim Consumer Spending and CAGR by Sector (2022-2027)” based on source]

Part V: Strategic Imperatives for Halal Certification Businesses

For companies specialized in Halal certification, the market trends highlight a mandate to move beyond basic auditing toward becoming strategic partners focused on integrity, technology, and ethical alignment.

1. Halal Integrity: The Anchor of Trust (Amanah)

In the diverse global market, the credibility of Halal assurance is paramount. Certification bodies embody Amanah (Sacred Trust). This trust is critical because consumers, particularly Dedicated Observers, rely solely on certification to affirm compliance.

The complexity of modern supply chains, especially in pharmaceuticals and food (dealing with issues like gelatin source and ingredient purity), demands rigorous standards. The challenge of maintaining Halal integrity “all along the food supply chain from farm to table” is widely recognized by industry leaders.

Strategic Action: Certification bodies must invest in advanced compliance methods that match consumer demand for transparency, such as adopting blockchain technology for food traceability. Technologies like the UAE’s Tatmeen for drug tracking exemplify the adoption of digital platforms to ensure integrity across the entire supply chain.

2. Leveraging the Halal Lifestyle Marketing Mix (HLMM)

To effectively serve global brands and sophisticated entrepreneurs operating in the Halal space, certification standards must align with the core Islamic value-based guiding principles that shape the market, articulated in DinarStandard’s HLMM Framework:

- Taqwa (Conscientiousness): Upholding a commitment to serve consumers and communities with care. For certification, this means maintaining the highest regulatory integrity and avoiding misalignment with Shariah principles, which could deter trust.

- Ihsan (Excellence): Providing high-quality standards and professionalism at every touchpoint. Certification must integrate seamlessly with global quality systems (like GMP) and uphold international standards, such as those published by SMIIC.

- Amanah (Sacred Trust): Delivering products and services grounded in integrity. Transparency, particularly regarding ingredient sourcing (e.g., APIs in pharma, gelatin in cosmetics/food), is the core business deliverable for a certification body.

- Adl (Socio-Economic Justice): Striving to provide tangible benefits to the community. This aligns with the push toward ESG-themed investments and Green Sukuk. Certification can lead the way by incorporating clearer sustainability standards within the Halal framework, moving beyond simply Halal toward true Tayyib principles.

[Insert Image Placeholder: “DinarStandard’s Halal Lifestyle Marketing Mix (HLMM) Framework Chart with 4 Guiding Principles: Taqwa, Ihsan, Amanah, Adl” based on source]

3. Embracing Disruptive Technology and Innovation

The GIE is rapidly integrating Fourth Industrial Revolution technologies. Businesses must keep pace:

- AI and Automation: AI is projected to improve efficiency and productivity, particularly in the Halal supply chain and compliance processes. Startups are already using AI for drug discovery (Insilico Medicine in Abu Dhabi) and Islamic learning (Ansari.ai chatbot).

- Novel Foods: The landmark ruling by Islamic scholars in Saudi Arabia that cultivated meat can be deemed Halal (provided conditions are met) opens a crucial avenue. Halal certification bodies must be prepared to integrate rigorous, science-based protocols to certify these novel food sources to capture this high-potential market.

- Fintech Integration: Islamic Fintech is highly vibrant. Businesses should look to integrate their certification services into Islamic supply chain platforms, leveraging digital platforms to enhance financial inclusion and transparency.

4. Addressing the Talent Gap

A major challenge for the growth of the Halal Pharma sector, noted by industry experts, is the scarcity of professionals who possess strong knowledge in both Shariah and applied science. This dual expertise is necessary to navigate the complexities of modern manufacturing while ensuring strict religious compliance. Certification bodies should lead initiatives for talent development and educational partnerships to bridge this critical knowledge gap.

Conclusion: The Aspirational Vision for the Next Decade

The Global Islamic Economy, valued at US$6.25 trillion, is a vibrant, expanding, and increasingly sophisticated market. Its growth is sustained by a young, digitally connected, and ethically driven consumer base, supported by government investment and regulatory development.

The aspirational vision for the next 10 years, according to the SGIE Report editorial team, is for the Islamic values-anchored economy to become a significant enabler of global socio-economic prosperity. This vision calls for exemplary success in areas such as developing global food supply chains that prioritize ethical labor and animal welfare, and creating a financial ecosystem that champions financial inclusion and sustainability innovations.

For business leaders, this demands a shift from merely viewing Halal as a compliance hurdle to embracing it as a comprehensive standard of Tayyib—quality, ethics, and social responsibility. By integrating the guiding principles of Taqwa, Ihsan, Amanah, and Adl, businesses can position themselves to be not only profitable entities but genuine forces for ethical development in this expansive global ecosystem.

The future of the Global Islamic Economy lies in integrity, innovation, and global partnership, making the role of credible Halal certification more strategically essential than ever before.

This article is based on data and analysis extracted exclusively from the State of the Global Islamic Economy Report 2023/24.