To Pharmaceutical Executives, Biotechnology Investors, and Certification Authorities,

The Halal Pharmaceuticals sector, a critical component of the Global Islamic Economy (GIE), is navigating a complex landscape defined by robust consumer demand, geopolitical turbulence, and a profound shift towards self-sufficiency in OIC (Organization of Islamic Cooperation) nations. This sector, driven by the ethical mandate of Shariah compliance alongside the global requirement for wholesome quality (Tayyib), presents a significant, growing market opportunity that demands strategic foresight and targeted investment.

This article, based on the latest data from the State of the Global Islamic Economy Report 2024/25, examines the sector’s current scale, the crucial trends driving its transformation, and the specific strategic imperatives for businesses operating within or seeking to enter this US$149 billion market.

Part I: Market Scale and Growth Trajectory

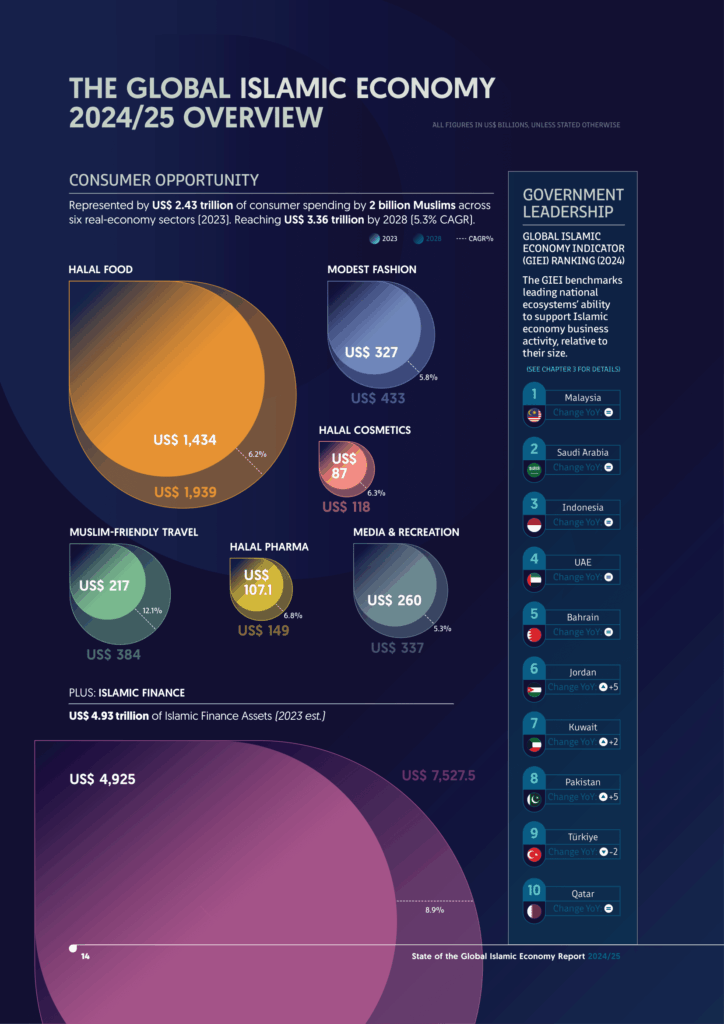

The Halal Pharmaceuticals sector is defined by the consumer spending of over 2 billion Muslims on essential medicines and health-related products.

Current Spending and Future Projections

In 2023, Muslim consumer spending on pharmaceuticals reached US$107.1 billion, representing a slight increase from 2022. This expenditure is forecasted to maintain a strong growth trajectory, reaching nearly US$149 billion by 2028, demonstrating a Compound Annual Growth Rate (CAGR) of 6.8%.

The largest markets by Muslim consumer expenditure on pharmaceuticals in 2023 were:

- Türkiye (retaining its top position).

- Saudi Arabia.

- The USA.

Investment Landscape and Trends

Investment activity in the Halal Pharmaceuticals sector, encompassing M&A, Private Equity (PE), and Venture Capital (VC), totaled US$656.2 million across 23 deals in the 2023/24 period.

This represented a 34.29% decline in the number of deals compared to the previous year, a decrease attributed primarily to the sector’s characteristic struggles with ambiguous Halal standards and resistance from some global pharmaceutical bodies. However, the sector still accounted for 11.4% of the total investment amount across all Halal-related sectors, confirming sustained investor interest in compliant healthcare and services.

Top Countries by Investment Deal Value (2023/24):

| Country | Deal Value (US$ Million) | Deals |

|---|---|---|

| UAE | $486.19 | 5 |

| Morocco | $94.43 | 2 |

| Indonesia | $21.54 | 6 |

| Saudi Arabia | $19.20 | 3 |

| Egypt | $12.37 | 3 |

Source: Adapted from SGIE 2024/25, Chapter 9 (Halal Pharmaceuticals).

The UAE leads in deal value, demonstrating its strategic positioning as a hub for healthcare investment, while Indonesia recorded the highest number of transactions, reflecting its active domestic market.

Part II: Key Structural Drivers and Opportunities

The current environment is characterized by two major, interconnected supply-side drivers: a strong government-led push for localization and the rapid adoption of advanced technology.

1. The Localization Imperative: Building Resilience

The reliance of OIC countries on imports for pharmaceuticals is a critical strategic challenge. In 2023, total OIC pharmaceutical imports reached US$49.40 billion. Notably, the top supplying markets are non-OIC nations like Germany (US$6.24 billion), the USA (US$5.36 billion), and France (US$4.55 billion). This dependency on external sources creates a national security risk, particularly in light of global instability and geopolitical conflicts.

Consequently, major OIC nations are aggressively pursuing localization strategies:

- Insulin Production: This is a crucial area of focus due to the growing global demand and the critical nature of the medicine.

- Saudi Arabia: Through Lifera (a PIF initiative), Saudi Arabia aims to localize over 50% of its insulin needs by 2027, partnering with Novo Nordisk Arabia to become the GCC’s first producer of biologic insulin.

- Indonesia: The Kalbe Group launched Ezelin, Indonesia’s first locally produced Halal insulin.

- UAE: Julphar is working with China’s Sunshine Lake Pharma to localize the manufacturing of modern insulin analogues in the MENA region.

- Medicine Localization: Saudi Arabia has identified roughly 200 medicines prioritized for localization projects. Egypt has increased its pharmaceutical factories by 37% and production lines by 60% to support domestic self-sufficiency.

- Halal Vaccines: Collaboration between the National University of Medical Science (NUMS) in Pakistan and Saudi Vax aims to manufacture Halal vaccines, demonstrating a joint OIC effort in specialized areas.

Strategic Opportunity for Investors: Localization efforts are being supported by significant government capital and policy, offering a framework for long-term strategic investment. Investors should align their strategies with these national priorities, particularly targeting vaccines and insulin production.

2. AI and Digital Innovation for Compliance and Discovery

Artificial Intelligence (AI) and automation are key growth drivers set to disrupt the pharmaceutical supply chain, promising enhanced efficiency and compliance.

- Drug Discovery: The UAE, recognized for its AI-centric National Strategy, is at the forefront of this trend. UAE-based Insilico Medicine has advanced the world’s first fully AI-generated drug to clinical trials.

- Regulatory Sandboxes: OIC countries are establishing regulatory sandboxes to foster digital health innovation while managing regulatory risk.

- Saudi Arabia launched a “Regulatory Healthcare Sandbox” to accelerate innovation in AI, 3D printing, IoT, and biotechnology.

- Abu Dhabi launched HealthX, providing successful applicants access to the DoH regulatory sandbox and de-identified data to refine products.

- Telemedicine: Digital technology is crucial for improving access to healthcare, especially in rural areas. Initiatives include the Islamic Development Bank (IsDB) supporting telehealth expansion in Afghanistan and projects deploying telehealth kiosks in rural Malaysia.

Strategic Opportunity for Certification Bodies: The application of AI to the supply chain will likely improve the efficiency and productivity of the Halal supply chain and ensure compliance. Certification bodies should explore AI-driven tools to verify ingredient purity, track complex supply chains, and streamline audits to meet the demand for integrity (Amanah) and quality (Ihsan).

3. Standards Harmonization and Halal Supplements

The lack of globally harmonized standards remains a major hurdle for the sector. However, key steps are being taken toward establishing a stronger Halal pharmaceutical ecosystem:

- SMIIC Adoption: The Azerbaijan Institute of Standardization (AZSTAND) adopted the state standard AZS OIC/SMIIC 50-1:2023, ‘Halal Medicines – Part 1: General Requirements’.

- Regulatory Guidelines: Indonesia’s Ministry of Health introduced a set of Halal manufacturing guidelines for drugs, biological products, and medical equipment in 2024.

- Halal Supplements: Halal adoption is notably higher in the vitamin and supplement category compared to complex medicine. Global brands are responding to the rising trend of healthy and preventive lifestyles among Muslims by certifying their products.

- Blackmores, an Australian finished goods manufacturer, attained Halal certification.

- Haleon Pakistan is set to manufacture the multivitamin brand Centrum locally.

- Nestlé Health Science and ChromaDex have introduced new halal-certified supplement ranges.

Strategic Opportunity: Supplements offer immediate high-growth potential due to easier certification and high consumer demand. For certification bodies, partnering with major global supplement manufacturers for accreditation and market entry strategy is a low-hanging fruit opportunity.

Part III: Strategic Imperatives for Certification and Business Growth

For a company specializing in Halal certification, the strategic focus must shift toward mitigating risks and enhancing credibility across the key opportunity areas.

1. Enhancing Halal Integrity in Complex Supply Chains

Certification is essential for addressing the dual vulnerability of mainstream brands: geopolitical scrutiny and broader ethical concerns (e.g., child labor, supply chain ethics). The core challenge remains ensuring Halal integrity where ingredients like gelatin, alcohol, or active pharmaceutical ingredients (APIs) are sourced internationally.

- Mitigating Counterfeits: The rise of counterfeit products is a serious concern, posing health risks and undermining consumer trust. Certification bodies must advocate for and integrate advanced traceability solutions.

- Blockchain Adoption: Investors should back blockchain-based Halal authentication and traceability solutions to safeguard market integrity by providing transparent, tamper-proof tracking of products from manufacturing to retail. A unified blockchain system among certifiers (like JAKIM, BPJPH, ESMA) could create a unified Halal certification framework.

- Ethical Sourcing (Tayyib): Halal requires products to be Tayyib (good and wholesome). Certification processes must robustly integrate social impact metrics, such as ethical labor and environmental practices, attracting ethical consumers globally.

2. Addressing the Talent Gap Through Collaboration

The growth of the Halal Pharma sector is limited by the scarcity of professionals with dual expertise in Shariah principles and applied scientific knowledge.

- Industry-Academia Links: Businesses and certification agencies must actively collaborate with academic institutions for R&D and talent development. Examples include Universitas Gadjah Mada (Indonesia) collaborating with UDST Qatar on Halal testing, and Biofarma/Padjajaran University hosting OIC Fellowship Programs for vaccine researchers.

- Halal Certification Training: Certification bodies are uniquely positioned to develop specialized training programs that bridge the gap between pharmaceutical science and Shariah compliance, thereby building the required expertise within manufacturing firms.

3. Positioning Halal as Innovation, Not Just Compliance

The long-term sustainability of the Halal sector hinges on delivering real innovation, not just focusing on high Halal compliance as the sole value proposition.

- Innovation in Supplements: Promoting supplements leveraging natural ingredients and healthy, preventive lifestyles appeals to both Muslim and non-Muslim consumers.

- Next-Gen Pharma: Certification frameworks must adapt to new technologies like AI-driven drug discovery and precision fermentation (for bioindustry ingredients) to ensure these next-generation products are deemed Halal and Tayyib.

Strategic Opportunity for Businesses: Businesses must integrate the Halal value chain early in their strategy to minimize later costs and align with the ethical and quality spirit of Halal. For example, Blackmores achieved its competitive edge by securing certification for its finished goods, reinforcing quality and compliance early on.

Part IV: Humanitarian and Social Impact (ESG)

The Halal Pharma sector is also defined by its role in global social impact, particularly through medical solidarity.

- Medical Solidarity: Ongoing global conflicts, such as the situation in Gaza, highlight the critical role of medical solidarity. OIC countries and international organizations, including the Islamic Development Bank (IsDB), are actively providing essential medical supplies like insulin and aid. This aligns the sector with the Social dimension of the GIEI.

- Zakat and Social Finance: Islamic social finance instruments are increasingly leveraged for health initiatives. For instance, in Tanzania, a sukuk was issued to fund the construction of a health center, marking the first time a non-financial institution in the country utilized this instrument, demonstrating the use of Islamic finance for social impact.

This convergence of localization, technological adoption (AI/digital health), and ethical investment underscores the Halal Pharmaceuticals sector’s evolution from a niche market to a strategic, high-growth area essential for global health resilience and Shariah-compliant integrity.